If you are sitting on more than $20,000 in credit card debt, your brain probably never really rests.

You might fall asleep doing the math in your head.

Minimum payments. Interest. Due dates.

The quiet fear that you are one emergency away from everything cracking is real.

This is where real, free credit counseling can change things.

Learning how to find free credit counseling is the first step. And once you see how to find free credit counseling that is trustworthy and clear, the whole debt picture starts to feel less permanent.

Table Of Contents:

- Why Seek Credit Counseling?

- How to Spot Legitimate Free Credit Counseling Fast

- Examples of Credit Counseling and Education Providers

- Local Support That Can Pair With Free Credit Counseling

- How to Find Free Credit Counseling Step by Step

- Preparing for Your Counseling Session

- Using Digital Tools and Apps Alongside Counseling

- Conclusion

Why Seek Credit Counseling?

Nonprofit credit counselors act as a neutral party to help you organize your debt.

A solid credit counselor can help you:

- Look at all your debts and interest rates in one clean snapshot.

- Create a realistic monthly budget that includes breathing room.

- Explain what late payments and credit utilization really do to your credit score.

- Walk through options like a debt management program, hardship programs, and bankruptcy counseling.

Many of the best agencies also teach you how to read a credit report and monitor your score. That way, you are learning how to avoid this exact pain in the future. They offer education on money management to help you stay stable.

How to Spot Legitimate Free Credit Counseling Fast

Plenty of companies love the word “free.” Then they sneak in high setup costs or back-end fees.

You do not have time or money for games like that. So let’s walk through the checks that separate the real counseling agency from the shady ones.

1. Check for Government Approval or National Backing

One of the safest starting points is to see if an agency is recognized by a credible body.

The Department of Justice keeps a list of approved credit counseling agencies for people going through bankruptcy.

If an agency shows up there for your district, it is a good sign that they meet certain standards. You can also look for groups that are connected to long-running nonprofit networks.

For example, the National Foundation for Credit Counseling has been around since 1951. You can call the nationwide hotline at 1-800-388-2227 or go through their listing of local agencies that have gone through vetting.

2. Look for Nonprofit Status and Transparent Fees

Nonprofit agencies may still charge small fees, but those fees should be clearly explained up front. You should not feel surprised once you sit down with a counselor.

Any program that asks for big upfront money, especially before they see your numbers, is a major red flag. Reputable agencies will share their pricing right on their websites or on the phone.

Many also reduce or waive fees for low-income clients.

A free first session is common with a legit credit counseling agency that is focused on real help. They prioritize your financial stability over pressure sales.

Most agencies provide a no-cost initial review.

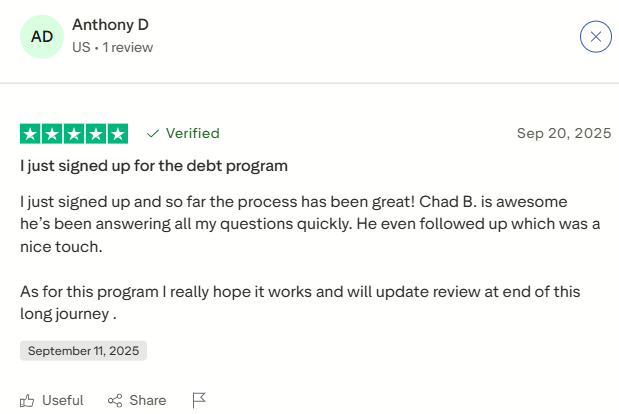

3. Read Reviews

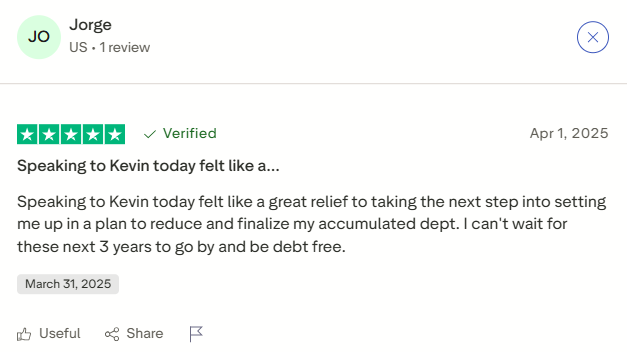

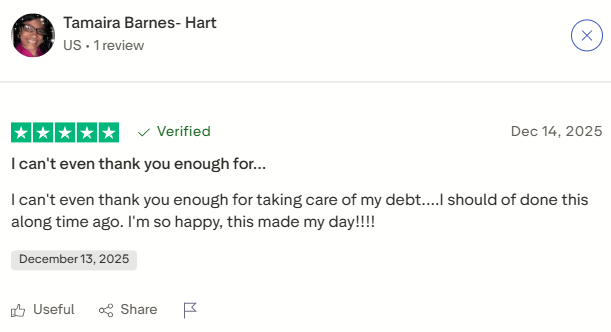

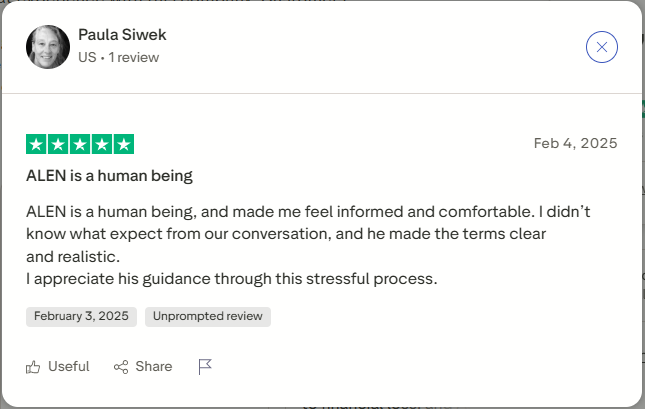

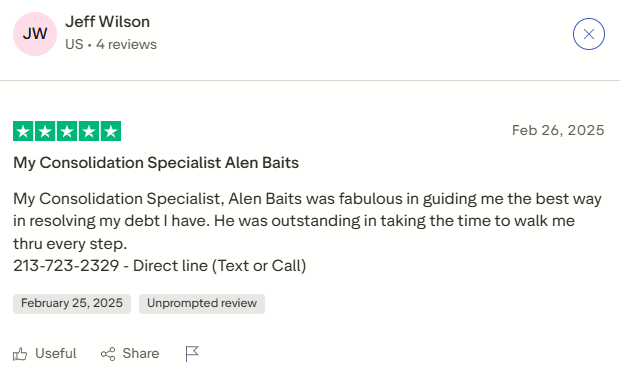

Reviews are not perfect, but patterns matter.

If you see complaint after complaint about surprise fees, ghosted clients, or wrecked credit, trust your instincts. Step away immediately.

On the other hand, look for comments that mention things like patience, education, and honest talk about options.

Look for reviews discussing how the agency handled consumer credit issues specifically.

Examples of Credit Counseling and Education Providers

To help you get started with your search, here are a few providers that you might want to consider.

Some are focused on bankruptcy education, some on broader credit and budgeting help. All provide low-cost or free services.

Always confirm current prices on their sites, because programs can change.

| Agency | How They Help | Contact |

|---|---|---|

| 0$ BK Class, Inc. | Online bankruptcy education courses that meet federal requirements for many filers. | Visit myonlinebankruptcyclass.com or call 877-376-7122. |

| Simple Class, Inc. | Internet-based courses to help people complete the required credit education for bankruptcy cases. | Learn more at simpleclass.net or call 866-742-6259. |

| Debtorcc, Inc. | Pre and post bankruptcy counseling in English and Spanish with web-based delivery. | Go to debtorcc.org or call 1-800-610-3920. |

| 1$ Wiser Consumer Education, Inc. | Credit counseling and education by phone and online in English and Spanish. | Visit 1dollarwiser.com or call 877-274-9479. |

| 123 Credit Counselors, Inc | Credit counseling and education, with telephone sessions available in English and Spanish. | See a123cc.org or call 888-412-2123. |

| Abacus Credit Counseling | Online and phone-based credit counseling, including bankruptcy education. | Go to abacuscc.org or call 800-516-3834. |

| Access Counseling, Inc. | Credit counseling and education in English and Spanish via phone and web. | Visit accesscounselinginc.org or call 800-205-9297. |

| Advantage Credit Counseling Service, Inc. | Nonprofit credit counseling, debt management plans, and education resources. | See advantageccs.org or call 888-511-2227. |

| Allen Credit and Debt Counseling Agency | Internet and phone-based debt counseling, including bilingual support. | Visit allencredit.com or call 888-415-8173. |

| American Consumer Credit Counseling, Inc. | Full-service credit counseling and debt management with free debt consultations. | Check ConsumerCredit.org or call 866-826-6924. |

Local Support That Can Pair With Free Credit Counseling

Money stress never lives in its own little box. If credit cards are high, there is usually a bigger story.

You might have rent, food, childcare, or job issues. This is where mixing counseling with local support programs can free up space in your budget.

Finding these financial resources can lower the pressure on you significantly.

Food, Housing, and Emergency Help

Take Bucks County in Pennsylvania as an example of how local governments can support you while you work on your debt. The county shares links for food assistance.

This includes nearby food pantries, nutrition programs, and help applying for SNAP benefits. Lower grocery costs can be the difference between a skipped card payment and staying on track with your plan.

This concept applies to your student loan payments as well.

The county also gives a rich list of housing and shelter resources. That list points to the Bucks County Housing Link and emergency shelters.

It also highlights programs such as emergency rental help and Section 8 housing. These kinds of tools help stabilize your basic needs.

This allows you and your credit counselors to work on debt numbers without panic.

Disability and Worker Protection Support

If part of your debt mess came from health issues or workplace problems, it is worth knowing your rights. For people with disabilities, Bucks County links to helpful services.

These include support for individuals with disabilities and adult protective services. They can even assist with questions regarding social security.

Help like this can protect your income or connect you to benefits.

Workers in places like Los Angeles County also have strong financial empowerment and labor tools. The county offers a large set of financial empowerment resources.

They include sections on worker protection, minimum wage laws, and more wage resources. If an employer underpaid you or broke wage rules, fixing that problem might become part of your debt solution.

Your financial health depends on ensuring your income is correct.

How to Find Free Credit Counseling Step by Step

By now, you know the types of help that exist. So let’s put this into a clear checklist you can follow over the next few days.

-

Gather your numbers. List all your credit cards, balances, interest rates, and minimum payments. You do not need it to be perfect. Just get a starting point.

-

Check a vetted directory. Look up counselors through the NFCC network, your state government website, or your court district’s list.

-

Check the agency site. Confirm nonprofit status if possible, read about services, and scan for clear fee explanations. Look for a member agency logo.

-

Call or submit a short form. Many groups let you book a free debt review by phone or online.

-

Ask the right questions. Ask how counselors are paid and if there are upfront fees. Ask what management programs cost each month and whether there is pressure to enroll.

-

Pair support services. If rent or food are tight, reach out to local help. Utilize resources from your county for food or housing.

-

Start with one small change. Maybe that means canceling a card you keep overspending on. It could be setting up autopay to start paying minimums effectively.

Preparing for Your Counseling Session

To get the most out of your free session, you should feel prepared. Gather your recent financial statements before you call.

Having your exact numbers ready makes the process smoother.

Be ready to discuss your income, expenses, and debts honestly. You will likely need to review their privacy policy before starting.

Legit agencies take data security seriously. They will ask for your written consent before pulling any credit reports.

They may also ask for permission regarding electronic communications. This allows them to email you budget worksheets or plan details.

Many agencies provide options to select language preferences as well, ensuring you understand every detail. Don’t be afraid to ask for a translator if needed.

Using Digital Tools and Apps Alongside Counseling

Maybe you like seeing numbers on a screen and tracking things daily. If that is you, you might connect well with money apps built for people trying to reset their finances.

Tools such as the CreditU app offer dashboards and education.

These tools support the behavior changes your counselor is encouraging. Many consumer credit counseling organizations also run secure client portals.

For example, some programs let you log in through portals like the ones linked on this client access page.

You might also use pre-bankruptcy client pages or follow up tools like the post bankruptcy course login. The idea is simple.

The easier it is to check in, the more likely you are to stick with the plan. Just be aware of media cookies and privacy settings when using free web tools.

Conclusion

If you are buried in over $20,000 of credit card debt, it is easy to feel like you are the only one. You are not.

And there are more paths to real help than most people ever hear about. There is a way to improve financial stability without bankruptcy.

Once you learn how to find free credit counseling through trusted channels, you can take action.

Start with one call to a vetted agency or one check of a state or national directory.

Your situation did not grow overnight, and it will not shrink overnight. But each honest conversation and each tiny step with a counselor pulls you farther away from panic.

Debt won’t fix itself — but the right plan can. Use Simple Debt Solutions to compare multiple loan offers in one place and find the option that helps you pay less and get out of debt faster.

That “should have done this long ago” is the universal refrain of people who spent years in the minimum payment trap thinking they were handling things responsibly.

That “should have done this long ago” is the universal refrain of people who spent years in the minimum payment trap thinking they were handling things responsibly.

Setting clear and realistic expectations (including challenges) demonstrates honesty.

Setting clear and realistic expectations (including challenges) demonstrates honesty.

Providing direct contact information demonstrates accessibility and accountability.

Providing direct contact information demonstrates accessibility and accountability. Proactive follow-up shows continued commitment beyond the initial sale.

Proactive follow-up shows continued commitment beyond the initial sale.